As Apple (AAPL.US) recently announced record-breaking sales and service revenue in the March quarter, the tech giant is now planning to raise over $5 billion through bond issuance. Despite having substantial funds, why is Apple resorting to this financial strategy, and what does it signify?

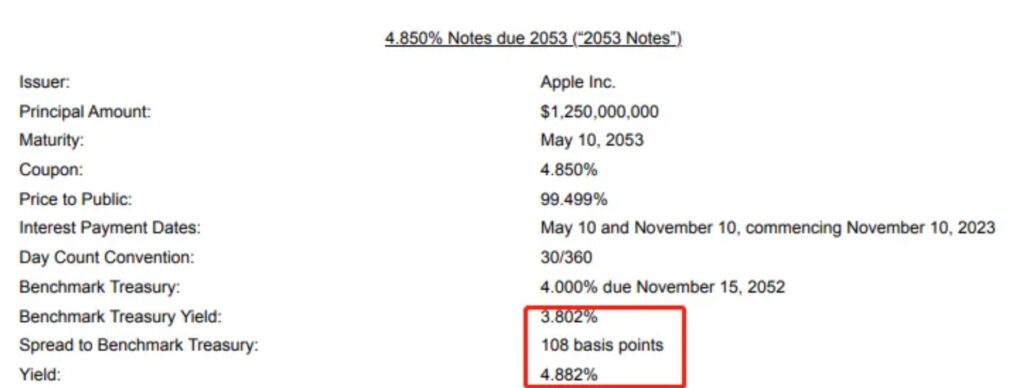

According to documents released on Apple’s official website, the bonds will be issued in five tranches with maturity dates in 2026, 2028, 2030, 2033, and 2053. These bonds will have durations of 3 years, 5 years, 7 years, 10 years, and 30 years respectively, with respective sizes of $1 billion, $1.5 billion, $500 million, $1 billion, and $1.25 billion.

Notably, this is not the first time Apple has tapped into the bond market for funding, as it raised $5.5 billion through bond issuance in August 2022. Currently, Apple holds one of the highest credit ratings among companies in the corporate bond market. Moody’s assigned it the highest AAA rating in December 2021, while S&P’s rating is AA+, and Fitch rates it AAA.

Based on the documents provided to the Securities and Exchange Commission on May 8, 2023, Apple plans to use the proceeds from the bond issuance for general corporate purposes, including stock buybacks, dividend payments, operational capital, capital expenditures, acquisitions, and debt repayments.

As disclosed in its March quarter financial results, Apple returned $23 billion in cash to shareholders, which includes $3.7 billion in dividends and the repurchase of $19.1 billion worth of shares, equivalent to 129 million shares.

Additionally, during the earnings announcement, the board of directors authorized an additional $90 billion for share repurchases, and the company raised its dividend by 4% to $0.24 per share.

Apple is in No Shortage of Money

Despite the extensive share repurchase program, which accounts for 3.3% of Apple’s current market value of $2.73 trillion and includes increased dividends, it’s worth noting that Apple itself holds substantial cash reserves and is not short of funds.

Apple’s Cash Reserves

As of March 31, 2023, Apple had cash and cash equivalents totaling $24.687 billion, marketable securities (current assets) worth $31.185 billion, and non-marketable securities, classified as non-current assets, reaching an astonishing $110.461 billion. In total, Apple has access to funds amounting to $166.333 billion.

Regarding debts, Apple only has $12.574 billion in interest-bearing debt due within one year and $149.927 billion in long-term interest-bearing debt. It is evident that the current cash, cash equivalents, and marketable securities held by Apple are more than sufficient to cover these liabilities.

Furthermore, Apple’s operating activities continue to generate substantial net cash inflows. For the six months ending on March 31, 2023, Apple’s net cash inflow from operating activities reached a staggering $62.565 billion.

Apple’s Financial Strength

Based on calculations by Chaihua News Agency using the company’s four-quarter performance, Apple’s operating activities have generated a net cash inflow of $109.584 billion for the twelve months ending on March 31, 2023. This amount is more than enough to cover the $90 billion share repurchase plan and also accounts for the anticipated $3.803 billion in dividends for the upcoming quarter.

The planned issuance of debt, amounting to over $5 billion, represents only 20% of Apple’s current cash level and a mere 5.6% of the $90 billion share repurchase plan. It is insignificant in comparison and holds no substantial impact.

Why is Apple issuing bonds?

According to Finance China, there are several reasons behind Apple’s decision to issue bonds:

- Effective tax avoidance

- Enhanced capital efficiency

- Cost-effective financing for higher-yielding stock repurchases, which is likely the primary motivation

Benefits and Implications for Shareholders

Issuing debt requires paying interest, and the interest expenses can help reduce Apple’s taxable income, thereby lowering its tax burden.

These taxable debts, due to their tax-deductible nature, result in reduced actual interest costs. Apple can then utilize these funds for higher-return investments and purposes, including investing in Treasury bonds (with interest costs only slightly higher than Treasury bonds and also eligible for tax deductions). This proves to be a more profitable approach for shareholders.

Apple’s significant buybacks and ongoing dividends are precisely what Warren Buffett finds advantageous. The repurchasing and cancellation of shares help enhance the existing shareholders’ equity, making it a more appealing choice for Apple’s current shareholders and attracting new investors. It also supports Apple’s stock price, particularly during periods of US deflationary uncertainty, playing a significant role in stabilizing the stock price.

Senior credit analyst Robert Schiffman further explains that Apple’s issuance of five batches of bonds is primarily driven by confidence in expanding cash flow rather than operational requirements. This move will aid Apple in achieving its goal of being “net cash neutral,” meaning the company’s cash reserves will roughly align with its debt levels.

US Liquidity Tightening

In recent times, there has been a tightening of liquidity in the United States, leading to several large companies, including Apple, planning for financing options. This article examines the impact of liquidity tightening and highlights the proactive financing measures taken by prominent enterprises.

Merck’s $6 Billion Bond Issuance for Acquisitions and Debt Repayment One of the leading pharmaceutical giants, Merck, plans to issue $6 billion in bonds. According to their filing with the Securities and Exchange Commission, the funds raised will be utilized for acquisitions, repayment of commercial paper, and other debts. Merck’s recent announcement of a $10.8 billion acquisition of biotechnology company Prometheus indicates their commitment to expanding their product line and bolstering their immunotherapy offerings.

Lucid’s $7.4 Billion Securities Issuance for Operational Capital and Expenditure Lucid, the electric vehicle manufacturer that recently reported its Q1 financial results, aims to raise $7.4 billion through various securities offerings. The primary utilization of these funds will be for operational capital and capital expenditure

The US Debt Ceiling Debate

Recently, the US Treasury Department faced mounting pressure regarding the debt ceiling, and the issue remains unresolved. The continuous expansion of the US debt poses a challenge to whoever holds the presidency, driven by its inherent political nature.

The debt ceiling was last raised on December 16, 2021, to $31.38 trillion. However, by October 2022, the US debt had surpassed $31 trillion. Since the onset of the COVID-19 pandemic in early 2020, the Treasury Department has reported an increase of $8 trillion.

In late April of this year, the debt ceiling was temporarily raised by an additional $1.5 trillion, bringing it to $32.88 trillion. However, it is evident that this adjustment falls short of meeting the requirements.

Currently, the US debt stands at a staggering $31.73 trillion. Treasury Secretary Yellen has expressed concerns that cash reserves will be exhausted by June, necessitating an increase in the debt ceiling. This measure is crucial to avoid default risks, fulfill government obligations, and enable the Treasury Department to issue bonds to pay bills

Concerns and Implications

At present, investors are growing increasingly apprehensive about the escalating US debt and the impact of Treasury bond issuances on the corporate bond market. As the US debt continues to rise, the Treasury Department must continuously issue bonds for financing. However, the Federal Reserve, its largest buyer, is reducing its balance sheet to address inflation concerns. This may result in a crowding-out effect, where the market becomes saturated with government bonds. Consequently, investors opt for lower-risk government bonds, diminishing the attractiveness of corporate bonds. This scenario intensifies the competition for funding between businesses and the government, further exacerbating the contraction of the US economy.

Anticipating these circumstances, companies have taken proactive financing measures to mitigate the high-cost risks associated with overcrowded markets. By initiating financing strategies in advance, enterprises aim to navigate the challenges arising from liquidity tightening and secure necessary funds for their operations