In the realm of finance, there are figures who captivate the imagination, leaving an indelible mark on the minds of Wall Street traders. One such enigmatic personality is Jesse Lauriston Livermore. Regarded as a pioneer of day trading and the influential force behind the acclaimed book “Reminiscences of a Stock Operator,” Livermore has become a legendary figure in the annals of financial history.

The Early Years

Background and Upbringing

Jesse Lauriston Livermore, born in 1877, emerged from humble beginnings as a member of a farming family. Growing up amidst the rural landscapes, he possessed an innate curiosity that would eventually lead him down an extraordinary path in the world of finance. From an early age, Livermore exhibited exceptional intellectual capabilities, astonishing those around him. By the tender age of 3½, he had already mastered the arts of reading and writing, a testament to his remarkable intellect and thirst for knowledge.

Livermore’s upbringing in a modest farming family laid the foundation for his work ethic and resilience. The values instilled in him during those formative years would serve as guiding principles throughout his life. Despite his humble origins, he possessed a burning desire to venture beyond the boundaries of his agrarian surroundings and immerse himself in the world of finance.

A Thirst for Knowledge and Mentorship

Livermore’s insatiable thirst for knowledge was a driving force in his journey to become a legendary trader. His natural inclination towards the financial world propelled him forward, seeking to unravel the intricacies of the markets and grasp the inner workings of Wall Street.

Yet, it was not solely his individual pursuit of knowledge that shaped Livermore’s extraordinary trading philosophy. Like many great minds, he benefited from the guidance of a mentor. This experienced figure played a pivotal role in shaping Livermore’s approach to trading, imparting wisdom and invaluable insights that would mold his unique perspective. The mentor’s influence proved instrumental in steering Livermore towards a path of success and honing his instincts for market analysis.

Livermore’s early years, marked by his thirst for knowledge and the guidance of a mentor, laid the groundwork for his future triumphs on Wall Street. These formative experiences fueled his relentless pursuit of financial expertise and set the stage for his subsequent rise to prominence as a remarkable trader.

The Trading Journey

Unconventional Methods and Ledger-Based Tracking

Jesse Livermore’s trading journey was marked by a distinct departure from conventional practices of his time. Unlike modern-day traders armed with sophisticated charts and technical indicators, Livermore relied on a simpler yet highly effective method: ledger-based tracking. Instead of relying on complex visual representations of market data, he maintained meticulous records of prices in a ledger, keenly observing the patterns that emerged.

Livermore’s trading approach was grounded in his affinity for stocks that exhibited clear trends. He had a keen eye for identifying stocks poised for significant price movements, and he actively avoided markets characterized by range-bound price action. By focusing on trending stocks, Livermore harnessed the power of momentum, capitalizing on the upward or downward movement of prices to maximize his trading opportunities.

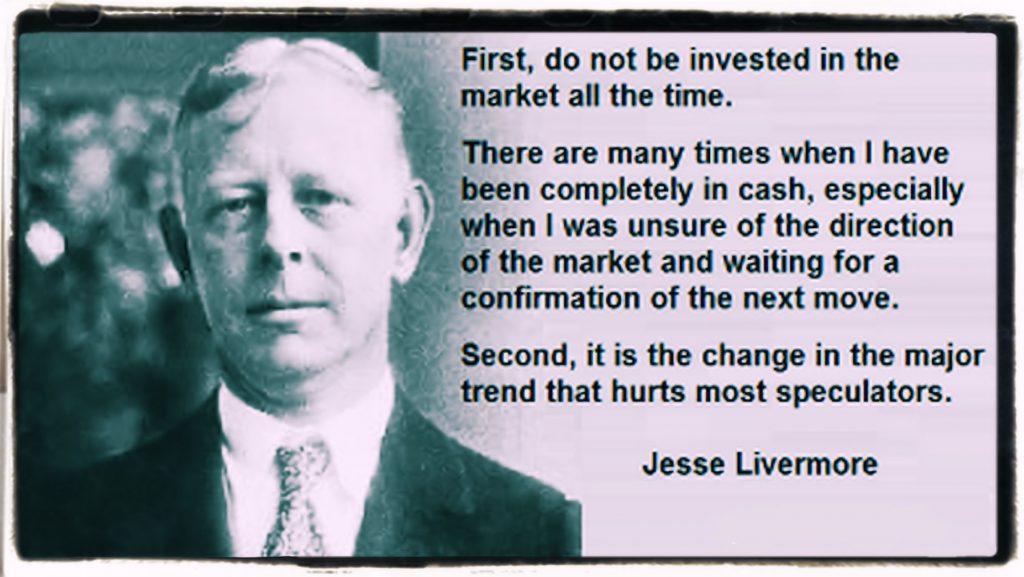

The Importance of Timing and Price Confirmation

Livermore firmly believed in the crucial role of timing in successful trading. He understood that being right about a trade was not enough; the timing of entry and exit points held equal importance. Livermore closely observed price patterns and pivotal points, waiting for confirmation before taking action. This patient approach allowed him to enter trades with a higher probability of success, minimizing the risks associated with premature or ill-timed entries.

Livermore’s emphasis on price confirmation was rooted in his conviction that price itself provided the most accurate timing signals. Rather than relying solely on external indicators or market sentiment, he trusted the behavior of price as the ultimate arbiter of market movements. Livermore recognized that price patterns and their reactions at critical levels provided valuable insights into the future direction of stocks and markets, enabling him to make well-informed trading decisions.

By combining an unconventional approach to trading with a focus on timing and price confirmation, Livermore set himself apart as a masterful trader. His ability to spot trends, avoid ranging markets, and patiently wait for price confirmation became hallmarks of his success.

Extraordinary Success and Losses

Trading Prowess and Independent Approach

Jesse Livermore’s trading prowess was nothing short of extraordinary. What made his accomplishments even more remarkable was the fact that he achieved them while managing his own funds and systems, free from the constraints of trading other people’s capital. Livermore blazed a trail as a fiercely independent trader, relying solely on his own instincts, strategies, and decision-making.

Livermore’s success was particularly noteworthy considering the era in which he traded. The markets of his time were thinly traded compared to the bustling exchanges of today. Yet, despite the limited liquidity and relatively slower pace, Livermore navigated the markets with unparalleled skill, consistently identifying lucrative opportunities and capitalizing on them.

Trials and Tribulations

While Jesse Livermore experienced extraordinary success throughout his trading career, he also faced periods of significant financial setbacks. It is through these trials and tribulations that he learned valuable lessons and developed a deeper understanding of the intricacies of the market.

Livermore was always candid about his mistakes and attributed his losses to two potential culprits. Firstly, he acknowledged that some losses resulted from inadequate formulation of trading rules. In certain instances, Livermore found that his trading strategies lacked the necessary refinement and specificity to address evolving market conditions. This realization prompted him to constantly refine and improve his trading rules, ensuring a more robust approach to future trades.

Secondly, Livermore recognized that losses were often the consequence of failing to adhere to the rules he had already established. The discipline to follow one’s own trading rules is a challenge faced by many traders, and Livermore was no exception. He openly acknowledged the importance of self-discipline and the detrimental consequences of deviating from established guidelines.

Livermore’s ability to reflect on his mistakes, learn from them, and adapt his approach was a testament to his resilience and growth as a trader. His experiences serve as a reminder to traders today to continually evaluate their strategies, establish sound rules, and adhere to them diligently.

The Enduring Influence

Livermore’s Evolution as a Trader

Jesse Livermore’s journey as a trader was characterized by evolution and adaptability. While he began his trading career as a day trader, he gradually transitioned into swing trading and long-term trading. This shift in approach allowed him to take advantage of broader market trends and capture larger profits over extended periods.

Livermore’s influence extended beyond his trading strategies. He was known for his manipulative tactics in the stock market, particularly targeting thinly traded stocks. Livermore sought out corrupt bucket shops, where he could manipulate prices and profit from his market expertise. This unconventional approach showcased his shrewdness and ability to exploit market inefficiencies to his advantage.

Legacy and Obsession

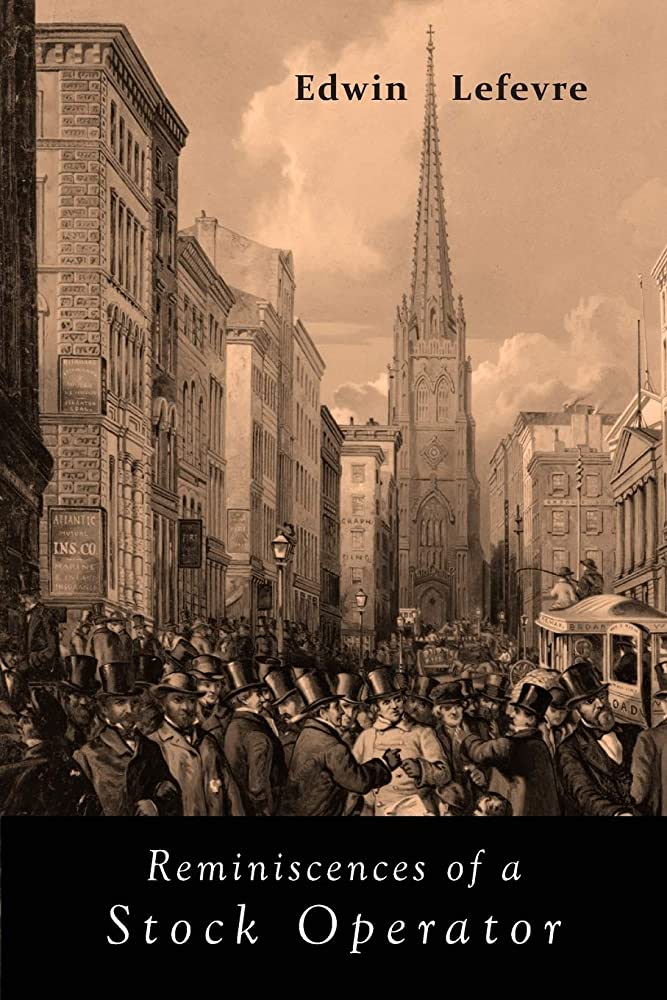

Jesse Livermore’s impact on Wall Street traders is undeniable, leaving an indelible mark on the financial industry. His trading philosophy and experiences continue to captivate and inspire traders to this day. One of the primary sources of insight into Livermore’s life and trading methods is the book “Reminiscences of a Stock Operator” by Edwin Lefèvre. This highly regarded book offers a glimpse into Livermore’s mindset, providing valuable lessons and perspectives for aspiring traders.

“Reminiscences of a Stock Operator” has attained a legendary status among traders and is often hailed as a must-read. It delves into Livermore’s triumphs, failures, and the psychological challenges he faced throughout his career. The book serves as a source of inspiration, offering insights into Livermore’s unconventional yet effective trading strategies.

The enduring obsession with Jesse Livermore among Wall Street traders can be attributed to his extraordinary success, innovative approach, and unwavering determination. Traders seek to unravel the secrets behind his achievements and gain valuable insights from his experiences. Livermore’s ability to navigate the markets with astuteness, adapt to changing conditions, and his willingness to share his knowledge have solidified his position as a legendary figure in the world of finance.