According to insider sources cited by the media on Wednesday, May 10th, US federal prosecutors are investigating short selling activities surrounding recent volatility in US bank stocks. The investigation was triggered by the collapse of three regional banks since March.

Over the past week, investors have become increasingly concerned about the health of US regional banks, with short sellers and traders profiting from betting on falling stock prices being closely watched.

The insider said that these short sellers’ activities related to the banking crisis were an “area of interest” for the Justice Department, which is looking for potential securities market manipulation.

According to media reports last week, other US regulatory agencies are also assessing potential market manipulation by short sellers, but the involvement of criminal prosecutors means that the risks faced by potential wrongdoers may increase significantly.

The insider said that the standards for launching a formal investigation are very high, and it is not yet clear whether prosecutors will eventually bring any charges.

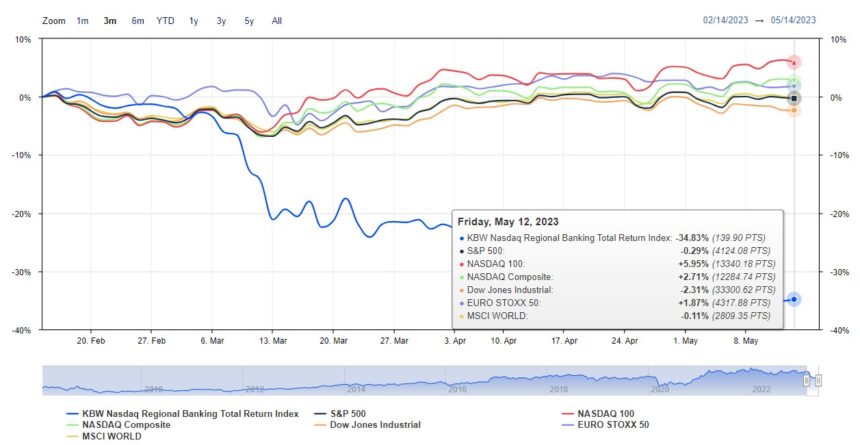

Since the collapse of Silicon Valley Bank on March 10th, the KBW Regional Banking Index has fallen by 24%.

Short selling of stocks refers to when stock investors borrow stocks from brokers or other agents when they expect the price of a certain stock to fall, and then sell them. Later, if the price of the stock falls, they buy it back at a lower price and return it to the broker to make a profit from the difference.

According to data from analysis company Ortex, short sellers profited from the banking crisis, earning $1.2 billion in book profits in the first two days of May.

Critics accused short sellers of harming companies, but short sellers believe that they play an important balancing role for listed companies.

Last week, the American Bankers Association urged the US Securities and Exchange Commission (SEC) to investigate “significant” short selling of bank stocks that “does not appear to reflect the financial condition of the issuer,” including short selling after positive market earnings reports.

The American Bankers Association said:

“We also observe widespread social media participation in assessing the health of various banks and the entire industry seems to be out of touch with potential realities.”

Since at least 2021, the US Justice Department and the SEC have been investigating short sellers and hedge funds’ short-selling research reports, as well as possible market manipulation.

Abu Dhabi Royal Family May be Involved in Shorting US Bank stocks

Recent reports suggest that international investors, including the Abu Dhabi royal family, may be shorting US bank stocks. It has been reported that Royal Group, an investment firm controlled by senior members of the Abu Dhabi royal family, has taken short positions worth billions of dollars on American stocks. The company is betting that concerns about the economy’s downturn will put pressure on the US stock market.

According to insiders, earlier this year, the Abu Dhabi royal family became more negative about the US stock market and shifted more of their investment portfolios towards short-term US treasuries. Royal Group has also increased its investments in commodities and cryptocurrencies. The company has been focusing on investing in emerging markets, and it has become a key tool for the UAE’s diversification strategy, given its significant oil resources.

The Royal Group hopes to profit from the potential market instability caused by the collapse of regional US banks and the expected global economic slowdown. As such, the Abu Dhabi-based company is a significant player in the short-selling market.

As the potential for credit tightening and rising oil prices could further weaken economic growth and push up inflation, the market is expecting the US to enter a recession in July, two months earlier than previously predicted.

Will a Short Selling Ban be Counterproductive for the Market?

As the U.S. regulatory authorities show more and more concern about short selling, there have been calls for a short selling ban in the market. However, the Chairman of the Securities and Exchange Commission (SEC) has stated that they are not currently considering prohibiting short selling.

Both Gary Gensler, the SEC Chairman, and California regulators have stated that they are watching for any potential misconduct. Gensler said last week that the agency is “particularly focused on identifying and prosecuting any form of improper conduct that threatens investors, market participants, or the broader market.”

Bryan Corbett, President and CEO of the Managed Funds Association, said:

“There is a strong academic record that shows that past bans on short selling by banks have harmed investors and failed to prevent stock price declines. Repeating these past mistakes would be improper regulatory behavior.”

There are already measures in place in the U.S. to restrict short selling. The SEC implemented a rule in 2010 that limits short selling if a stock drops more than 10% in one trading day to maintain investor confidence.