John B. Neff, Peter Lynch, and Bill Miller are widely recognized as the three pioneer of the American investment community.

For a remarkable 31 years, John B. Neff managed the Windsor Fund, achieving astonishing results. The total investment return reached an impressive 5545.6%, while the S&P 500 index only managed 2229.7% during the same period. The annualized return rate was 13.7%, consistently outperforming the S&P by 3.5 percentage points per year on average.

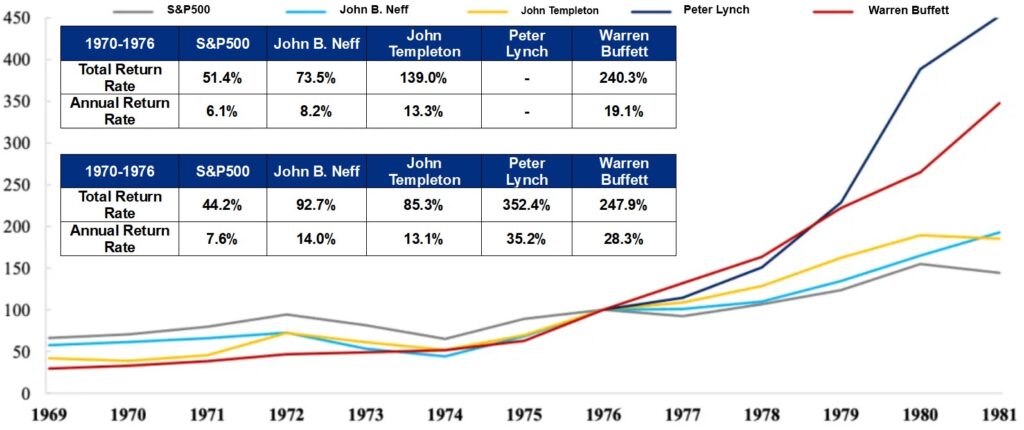

From 1970 to 1976, Warren Buffett, John Templeton, and John B. Neff outperformed the market by 188%, 88%, and 22% respectively.

From 1977 to 1981, Peter Lynch emerged as the leader, surpassing the market with a return of 308%. Buffett achieved a return of 204%, Neff achieved 48.5%, and Templeton achieved 41.1%.

Among these investment masters, John B. Neff is hailed as the “P/E Ratio Pioneer and Value Discoverer.” His name is not as widely known among value investors as Buffett, Templeton, or Lynch, both domestically and in the United States. This is partly due to his low-key demeanor.

However, there have been surveys indicating that he is regarded by Wall Street fund managers as the preferred manager for managing their own money, the chosen “FOF Fund Manager” by public opinion.

💡The Biggest Risk Is Not Price Risk, It’s Quality Risk: Focus on Long-Term Returns Driven by Company Growth.

John B. Neff

🔆The Dawn of Windsor Fund🔆

John B. Neff, the former key manager of Windsor Fund under The Vanguard Group, once the world’s largest investment management company.

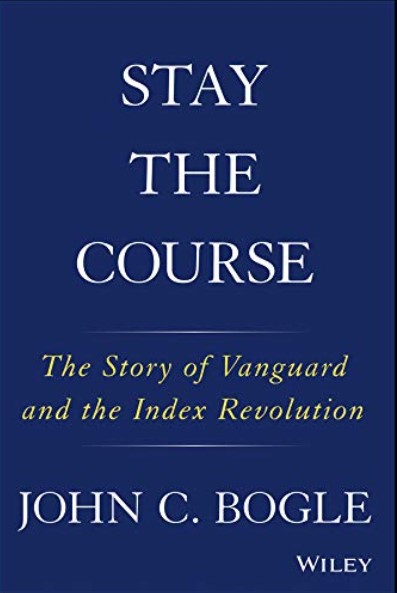

The founder of Vanguard Group is the renowned “Father of Index Funds,” John Bogle. (Note: John Bogle is the creator of the world’s first index fund, Vanguard 500 Index Fund.)

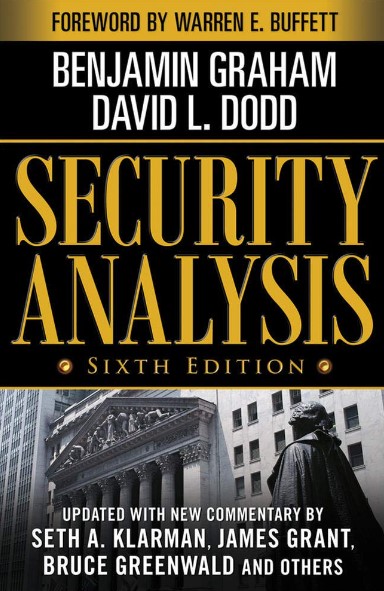

In 2006, John B. Neff ranked sixth among the top ten global fund managers selected by The New York Times. The top five were Buffett, Peter Lynch, John Templeton, Benjamin Graham, and David L. Dodd (co-authors of “Security Analysis“), followed by George Soros. John Bogle ranked seventh.

In his book “Stay the Course: The Story of Vanguard and the Index Revolution,” John Bogle recalled, “Windsor Fund had poor performance in its early years, with no clear investment direction. From 1958 to 1964, while the S&P 500 Index had an annual return of 11%, Windsor Fund only achieved 7.7% return. It wasn’t until mid-1963 that Windsor Fund’s assets surpassed $75 million. Legendary fund manager John B. Neff joined and completely rewrote the history of Windsor Fund.”

In the summer of 1964, John B. Neff became the portfolio manager of Windsor Fund, and “a camaraderie between us was established.” wrote John Bogle.

John B. Neff described his acquaintance with John Bogle like this, “We connected instantly; there were certain qualities about me that particularly attracted Bogle. I was well aware of it. For example, we both had flat-top haircuts.”

Time is always the most effective test, and there are not many who can withstand it. John B. Neff is one of them.

From managing Windsor Fund in 1964 to retiring from The Vanguard Group in 1995, John B. Neff managed the fund for 31 years. He transformed the struggling Windsor Fund into the largest mutual fund at that time, achieving a total investment return growth of 5,545.6% (compared to the S&P index return of 2,229.7%).

The fund had an annualized return rate of 13.7% (compared to the S&P 500 index’s 10.6%), outperforming the market 22 times with an average annual return rate 3% higher than the market.

At first glance, 3% may seem insignificant, but it was achieved with far less risk than the market average. Only a few exceptional individuals like Buffett have been able to maintain such a leading position over the long term:

- John B. Neff, 31-year compound annualized return of 13.7%;

- Buffett’s classmate and co-founder of Sequoia Fund, Bill Ruane, 36-year compound annualized return of 15.5%;

- John Templeton, 38-year compound annualized return of 16%;

- Buffett’s senior brother, Walter Schloss, 47-year compound annualized return of 15%;

- Buffett, 57-year compound annualized return of 19.8%;

According to John Bogle, John B. Neff didn’t take long to prove the value investing principles he adhered to through his performance. Under John B. Neff’s leadership, “Windsor Fund demonstrated both a conservative and aggressive nature.”

“The conservative” refers to John B. Neff’s focus on investing in distressed stocks and high-dividend stocks, which effectively controlled the fund’s downside risk.

“The aggressive” indicates Neff’s willingness to heavily invest in stocks he believed in, resulting in greater short-term volatility compared to portfolios with diversified holdings. Nevertheless, Windsor Fund began to shine in the industry.

John Bogle also provided a detailed supplement on John B. Neff’s performance in his book:

“In 1965, the Windsor Fund began to shine. By 1970, the fund had an annualized return of 12.6%, while the S&P 500 index only had a 4.8% annualized return during the same period. From 1970 to 1973, there was a growth stock market, and the Windsor Fund underperformed the market.

However, from 1974 to 1979, the Windsor Fund had an annualized return of 16.8%, while the S&P 500 had a 6.6% annualized return during the same period. From 1965 to 1979, the Windsor Fund accumulated a return of 359%, while the S&P 500 accumulated a return of 126%.”

Such outstanding performance inevitably attracted additional investments from investors and brokers. Even after the increase in size, the Windsor Fund continued to perform excellently. In contrast, other successful funds during the same period often experienced a decline in performance after receiving more funds.

Coupled with John B. Neff’s highly actionable investment approach, John Bogle regarded him as a “true star fund manager” on par with Peter Lynch.

In fact, entering the asset management industry in 1964 was not considered fortunate because over the next 17 years, the Dow Jones Industrial Average (DJIA) only increased by one point from its 1964 year-end level of 874 points, reaching 875 points by the end of 1981.

However, during a period when most stock investors were losing money, John B. Neff achieved unprecedented success.

In 1981, the assets under management of the Windsor Fund were less than $1 billion. By the end of 1985, Windsor’s assets exceeded $4 billion, making it the largest equity fund in the United States. When John B. Neff stepped down from his role as fund manager in 1995, the fund’s assets had expanded to $11 billion.

Mean reversion of performance seems to be an inevitable fate in the mutual fund industry. However, the Windsor Fund became an exception. Except for a brief downturn from 1989 to 1990, the Windsor Fund achieved an annualized return of 17.2% from 1980 to 1992, surpassing the S&P 500 index by 1.2% each year.

3 Pioneer of American mutual funds

Closing the Gates

In May 1985, John B. Neff and John Bogle, this legendary duo, did something unheard of in the mutual fund industry—they closed the gates to Windsor Funds’ subscriptions.

🐔 Why stop a chicken that lays golden eggs?

“Under the traditional structure of fund governance, fund managers are reluctant to proactively close fund subscriptions and give up substantial management fee income. But Neff and I were well aware that no matter how tall a tree grows, it cannot reach the sky forever.

Otherwise, the growth in fund size would eventually become the enemy of performance. We had no motivation to blindly expand the scale and earn management fees.”

Embracing the Proposal

When John B. Neff presented this proposal to John Bogle, the two immediately agreed.

John B. Neff, born in 1931, and John Bogle, born in 1929, these two friends who were two years apart, both passed away in 2019.

Managing the Donation Fund

In 1980, the University of Pennsylvania asked John B. Neff to manage the school’s endowment fund. The fund’s income had been the worst among 94 university funds over the past few decades. John B. Neff still used his old method of buying low-profile, unpopular, but extremely cheap company stocks.

Some trustees opposed this approach and urged him to invest in stocks that seemed very exciting at the time. But John B. Neff was unmoved, and the results proved him right.

Exceptional Returns

Within 16 years, the fund achieved a tenfold investment return, catapulting it into the top five among university funds for the next several decades.

John Neff on Investing

Explore the “Worry-Faced” Stocks in the Cold Zone❄️

John B. Neff didn’t employ any sophisticated investment techniques or mathematical models; he simply used a well-known investment approach—the Low Price-Earnings (P/E) Method.

He believed that stocks with low P/E ratios offered dual profit margins, providing both significant upward potential and reduced risk of losses.

Mainstream perspectives often overlook the value of good companies, as they only focus on the hottest enterprises of the moment.

John B. Neff

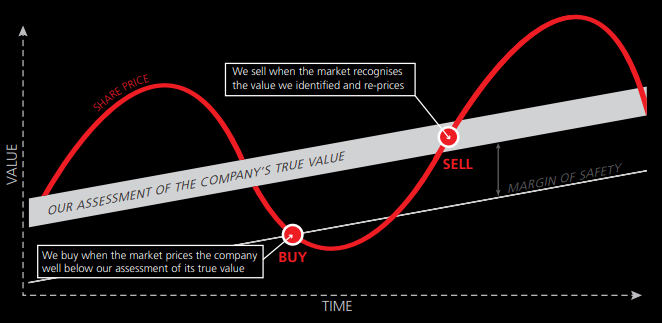

In his own words, he would always buy those inconspicuous, underperforming yet incredibly cheap stocks—stocks with a misunderstood “worry-faced” appearance—and sell them when the market rediscovered their value, leading to strong price trends.

In his book, Stay the Course: The Story of Vanguard and the Index Revolution, John B. Neff also shared that it is relatively easy to obtain the P/E ratio information for every company. “In addition to services like ValueLine and other paid subscriptions, newspaper stock charts usually include the P/E ratios of each stock, and all reputable personal finance websites also publish this data.”

John B. Neff started working in the business world while still in high school. His father was involved in the automotive and industrial equipment supply industry and allowed him to participate in the business management.

A phrase that his father often mentioned was, “To sell well, you must buy well,” teaching him to pay special attention to the price paid. This experience and the phrase had a profound impact on him.

To sell well, you must buy well

Father of John B. Neff

Some call John B. Neff a value investor, while others label him a contrarian investor. However, John B. Neff prefers to refer to himself as a low P/E investor:

“Some people believe I am a value investor. That esteemed investment style originated from the pioneering research of legendary figures Benjamin Graham and David L. Dodd. They illustrated through examples that stocks previously abandoned by investors during the depths of the Great Depression often outperformed popular hot stocks.

Others say I am a contrarian investor. This label is rather ambiguous and evokes rebelliousness.

Personally, I prefer another label: a Low Price-Earnings Investor. This label accurately and precisely describes my investment style during my tenure at Windsor Funds.”

contrarian investing

We generally understand contrarian investing, which is based on the emergence of extremely undervalued companies with potential for reversal. Following this logic, even if John B. Neff doesn’t want to be called “rebellious,” we still have to put that hat on him.

Among his notable contrarian investment cases, Citigroup is the most famous. During Citigroup’s decline from $33 to $8, Neff kept buying all the way and ultimately reaped multiple returns.

It is worth mentioning the warning he once issued:

Windsor’s success does not come from always going against the crowd. Those who stubbornly oppose for the sake of opposition will eventually meet a tragic end. Intelligent contrarian investors, with an open mindset, can humorously navigate investments based on their understanding of history.

Recently, during a conversation with a research director from a billion-dollar private equity firm, he mentioned that those who can traverse the river of time in investments do not depend on whether someone has mastered some investment bible, but rather if they can adhere to a simple yet logical investment strategy.

This holds true, just like John B. Neff.

Since 1964, managing the Windsor Fund, for 30 years, “the Windsor Fund has never been flashy, never blindly chasing trends, but also not satisfied with market average performance. Whether the market rises, falls, or remains flat, we have consistently followed a timeless investment style.”

7 elements and 2 reasons of stock purchasing and selling

John B. Neff, published his autobiography titled “John Neff on Investing” in 2001, documenting his personal growth and early experiences in education and employment. Additionally, the book provides detailed descriptions of his investment career and philosophy.

In the book, he summarizes his investment style using low price-to-earnings (P/E) ratio, consisting of seven elements:

- Low P/E ratio (referring to a company’s P/E ratio being 40%-60% below the market average).

- Fundamental growth rate exceeding 7% (rarely selecting stocks with growth rates below 6% or above 20% as they come with high associated risks).

- Dividend yield as an added bonus (dividend yield provides additional points).

- Excellent total return relative to the paid P/E ratio (John Neff prefers stocks with a P/E ratio half of their total return rate).

- Holding cyclical stocks only if compensated by a low P/E ratio (during his tenure at Windsor, John Neff purchased oil stocks, specifically ARCO Southwest, at six different times).

- Steady companies within growth industries.

- Strong fundamental support.

These factors, both quantitative and qualitative, revolve around the foundation of a low P/E ratio. However, additional elements are necessary to support and ensure the value of low P/E stocks.

The fourth element, total return rate, is a term coined by John Neff, calculated as the sum of earnings growth rate and dividend yield. Total return rate divided by the P/E ratio equals the total return on investment.

Although the low P/E investment strategy appears simple, it is not easy to implement. It requires long-term “buying overlooked stocks” and the ability to remain unfazed by popular market opinions and skepticism.

Windsor Fund sells stocks for only two ultimate reasons:

- Deteriorating fundamentals.

- Price reaching the predetermined value.

From the seven elements mentioned above, John Neff’s investment strategy is quite conservative.

But in his own words, “With it, we can still hope to find investment opportunities that offer greater profit potential for Windsor Fund in an industry where nothing is guaranteed. The process is not smooth and often filled with bumps, but in the long run, it outperforms peers.”

Citigroup, mentioned earlier, serves as a typical investment case for John Neff. As early as 1987, when Citigroup was listed as one of the “Nifty Fifty” star stocks, its stock price began to decline. In 1991, Citigroup was entangled in numerous bad mortgages and massive write-offs, causing its stock price to plummet, triggering panic selling by countless investors.

Fearless, John Neff continued to buy Citigroup stocks despite temporary substantial paper losses. By the end of 1991, when Citigroup’s stock price dropped to around $8 per share, Windsor Fund held 23 million shares of Citigroup.

John Neff believed that Citigroup’s profitability remained intact and, with rapidly decreasing costs, stronger profit expectations became clearer. Simultaneously, he believed that the mortgage problem would eventually be resolved.

In 1992, Citigroup’s profitability turned around, and its stock price began to rise. It experienced a 43% surge in a single year. In 1993, amid a sluggish market, Citigroup continued to rise nearly 25%. After nearly five years of long waiting, Citigroup’s stock price multiplied more than eightfold, providing Windsor Fund a tumultuous journey of success.

Ugly stocks often turn out to be beautiful. If Windsor Fund’s investment portfolio appears too easy to be recognized, then we are merely going through the motions. Citigroup was not the first or the last stock of this kind.

John Neff

Buy to Sell

For John B. Neff, all the techniques of finding low P/E ratio stocks serve one goal: calculating the price range of a company’s stock after its performance improves.

“Every stock purchased by the Windsor Fund is meant to be sold. If other investors cannot see what you have been trying to make them see—the company’s potential—then you will never achieve the expected returns.

Can you guarantee that the price of a stock you are ready to sell will meet your expectations? No one can, but adopting a low P/E ratio strategy can at least tip the probability scales in your favor.”

Different from many Buffett-like value investors, Neff is focused on predicting the direction of the economy and the future earnings of specific companies. Additionally, his average holding period for individual stocks is three years. However, there are also similarities, such as a focus on return on capital.

When it comes to the questions of “When to buy” and “At what price to buy,” John B. Neff’s approach is to first predict the company’s earnings for the coming years and then predict the P/E ratio of the stock several years later under normal market conditions.

Once the earnings and P/E ratio are determined, the target price for the stock for those years is also determined. Subsequently, he calculates the discount ratio of the current market price relative to the target price of the stock. By subtracting this discount ratio from 1, he obtains the potential rate of appreciation for the stock.

As for the questions of “How to sell stocks” and “When to sell stocks,” John B. Neff has two principles:

- He is willing to sell stocks at the market price and according to the selling strategy. The determination of the target selling price is also based on the “minimum acceptable rate of return” for the entire portfolio. When the market becomes optimistic about a company in which he holds shares, the price of that company’s stock rises, and soon its stock potential falls below that of other stocks in the portfolio.

- When the potential rate of appreciation for a stock drops to only 65%-70% of the average potential rate of appreciation for the entire investment portfolio, John B. Neff starts selling.

Essential Qualities of Successful Active Investors: Patience and Persistence 🧘♂️🏋️♂️

In March 2017, Jim O’Shaughnessy, who manages over 30 billion dollars in assets, published an article on his Yahoo blog, explaining the seven essential qualities he believes successful active investors must possess.

One of those qualities is patience and persistence, and the case in point is John Neff:

“Neff favored stocks with low P/E ratios, high dividend yields, and high return on equity. However, his short-term performance lagged behind the market, similar to Warren Buffett at the time. Neff stayed true to his principles and eventually achieved outstanding returns for his investors.”

Nothing in this world can replace persistence. Talent won’t do it, genius won’t do it, education won’t do it. Only with perseverance and determination can one make progress.

Calvin Coolidge, 30th President of the United States

At the end of the article, we have selected ten investment maxims from John Neff. Each one is thought-provoking, and let’s take a moment to revisit them together:

10 Investment Maxims from John Neff

- “Those who stubbornly oppose for the sake of opposition will ultimately suffer a tragic fate. Smart contrarian investors, with an open mind and a sense of historical understanding, can invest with humor.”

- “I believe success does not come from personal talent or foolish intuition, but from frugal nature and the ability to learn from various lessons.”

- “If you can’t bear the ups and downs of stock prices, or if you are too impatient, it’s better to honestly keep your money under the pillow.”

- “The market has an astonishing ability to make mistakes, and there are always undervalued stocks available. If investors can apply effective methods to judge growth prospects and concentrate their investments on stocks with the highest expected returns, the world will be at their disposal.”

- “It is only when the great growth stocks are pushed into the abyss by an impulsive market that we may pick up the cheap goods discarded by others. Even in that situation, we should exercise restraint.”

- “Hard lessons are only useful when investors remember them. But history repeatedly tells us that the memory of the stock market is surprisingly short. Investors often forget the past.”

- “Negative news always outweighs positive news, and even excellent companies can suffer from investors’ bad mood. In every industry, there will eventually be bargains with low price-to-earnings ratios available for picking.”

- “After a certain frenzy trend emerges, the crowd will respond to each other and become uncontrollable. If you don’t agree with this, you might as well be the first to applaud at the next meeting. Most people find it difficult not to join the clamor.”

- “Smart investors do not put all their eggs in one basket, but if the diversification is too excessive, they will be hamstrung.”

- “We are not always right; sometimes we underestimate the numbers and sell too early. But compared to holding onto stocks and sliding down the wrong side, it’s only a small price to pay.”