2023 has already passed six months, which have been extremely volatile months for the market. The market changes seemed to happen overnight, coupled with the aggressive moves of forced liquidation institutions and the impact of quantitative funds, which I believe many investors are struggling to navigate.

Have you ever experienced a situation like this? You had great confidence in your positions, conducted thorough fundamental analysis from various angles, and the feedback data from the industry constantly validated your judgments.

However, your holdings gradually declined while other stocks kept soaring.

At this point, we constantly doubt ourselves: Did I make a mistake? Are there any perspectives or risks that I haven’t considered? Did I not pay enough attention to certain transformations or changes?

Therefore, two questions arise. First, how to evaluate our holdings in such intense competition, high volatility, and obvious structural changes in the market? Second, how to deal with our emotions?

Maintain Objectivity and Respect the Cycle

Howard Marks once said that a character not easily swayed by emotions is one of the most important factors for successful investors and one of the longest-held conclusions he has observed.

Not being influenced by emotions means being “objective.” Objectivity may seem simple, but in reality, it is a high behavioral standard because very few people can truly be rational, objective, neutral, and stable.

Whether making profits or losses from holdings, it may simply be a result of “luck.” Here, luck does not mean no research or analysis, but rather that the decisive factors determining stock price fluctuations may be fundamentally different from our analytical perspective, but we are not aware of it.

Therefore, there is no need to be excessively jubilant when making profits or overly pessimistic when facing losses.

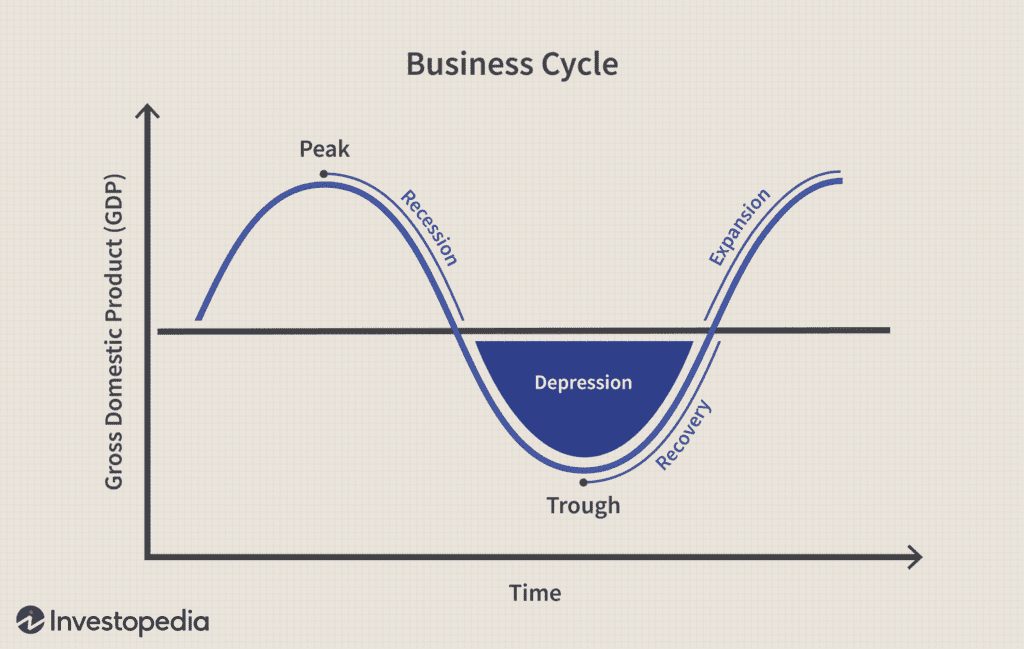

Respect the Economic Cycle

For personal holdings and industries that are performing well in the market, it is important to constantly evaluate the positive and negative factors objectively.

Do not selectively perceive, distort interpretations, or deliberately ignore due to having conducted more research on your own holdings and less attention to other industries. Also, avoid always seeking news that confirms the conclusions you already have in your mind.

On the other hand, the market’s main trends do have cyclical changes, and the early, middle, and late stages of each trend will continuously undergo fluctuations in profitability, valuation changes, and industry logic. Although there may be twists and turns in the micro perspective, the overall direction is relatively clear.

By adjusting positions, leverage, and industry allocations, constantly evaluate your holdings, keep the risks within an acceptable range, and then hold firmly, avoiding chasing highs or selling at lows.

Three Levels of Handling Emotions

There are three levels at which investors handle their emotions.

01. Constantly swayed by emotions, switching between fear and greed, chasing highs and selling at lows

Charles P. Kindleberger once said in “Manias, Panics, and Crashes: A History of Financial Crises,” “Nothing is so disturbing and distressing as to see a friend get rich.” The pain for these individuals comes from seeing others making money while they repeatedly miss opportunities.

Eventually, their confidence diminishes, their willpower weakens, and they give up resistance. These people often either buy at high levels or sell at low levels, causing their net asset value to continuously shrink.

02. Being aware of the negative effects of emotions and striving to accept them with objectivity and neutrality

It is not easy to reach this level. Those who achieve it have strong faith in their own judgments, continuously review and make adjustments along the way, and have the courage to go against the market without panic.

03. Being able to anticipate and utilize these emotions for strategic moves.

People at this level can see public sentiment as a factor that can be utilized and manipulated. They deeply understand that when stock prices are low, the probability of making money increases, and when prices are too high, the probability of losing money increases. Therefore, they become the “smart ones” who act ahead of the market.

Things often have their ups and downs. Psychological emotions play a vital role in driving cycles with extraordinary swings. When the market goes against us, controlling our emotions and making objective judgments becomes crucial.

If we are truly wrong, it is important to cut losses in a timely manner, and the present moment is the time when losses are minimized. If we still firmly believe in our judgment, we should not be disturbed by short-term fluctuations.”