In the ever-evolving landscape of the U.S. startup world, the elusive unicorn is no longer a myth. Over the past 25 years, a remarkable phenomenon has taken place, with a staggering number of private startups achieving the coveted $1 billion valuation.

These unicorns have not only disrupted industries but also attracted the attention of established companies looking to stay ahead of the curve through strategic acquisitions.

Understanding Unicorn Acquisitions

Importance in the startup ecosystem

Unicorn acquisitions, in essence, refer to the strategic purchase of private startups that have achieved a valuation of $1 billion or more.

These acquisitions hold immense significance in the startup ecosystem, serving as a catalyst for innovation, growth, and market disruption. Understanding the dynamics behind unicorn acquisitions is crucial for both established companies seeking to stay competitive and startups aiming to scale their operations.

Two key factors drive unicorn acquisitions

Two key factors drive unicorn acquisitions: the rate at which new unicorns are minted and the climate for mergers and acquisitions (M&A) transactions more broadly. As mentioned in a report by AZ Central [5], these factors heavily influence the frequency and intensity of unicorn acquisitions.

Rate of new unicorn formations

The first factor, the rate of new unicorn formations, highlights the entrepreneurial spirit and ingenuity prevalent in the startup landscape.

With technological advancements and evolving market demands, more startups are achieving billion-dollar valuations than ever before. This rapid growth and the potential for disruptive innovation make unicorns attractive targets for acquisition.

Climate for M&A transactions

The second factor, the climate for M&A transactions, encompasses the economic, regulatory, and industry-specific conditions that influence acquisition activities.

Favorable economic conditions, investor sentiment, and the availability of capital all contribute to a conducive environment for unicorn acquisitions. Additionally, industries experiencing significant disruption or consolidation are more likely to witness a surge in unicorn acquisitions.

Well-known unicorn acquisitions shaped the startup landscape

Several well-known unicorn acquisitions have played a transformative role in shaping the startup landscape.

Instagram in 2012

One notable example is Facebook’s acquisition of Instagram in 2012 for a staggering $1 billion. This strategic move allowed Facebook to expand its social media dominance and tap into the burgeoning world of visual content sharing.

GitHub in 2018

Another significant unicorn acquisition took place in 2018 when Microsoft acquired GitHub, a popular platform for developers, for $7.5 billion. This acquisition solidified Microsoft’s commitment to supporting developers and leveraging their expertise to enhance its own software offerings.

Slack in 2020

Furthermore, in 2020, Salesforce acquired Slack, a widely used communication and collaboration platform, for approximately $27.7 billion. This acquisition demonstrated Salesforce’s ambition to strengthen its position in the enterprise software market and capitalize on the growing demand for remote collaboration tools.

These examples illustrate how unicorn acquisitions can drive innovation, diversify business portfolios, and open new avenues for growth. By acquiring unicorns, companies gain access to cutting-edge technologies, disruptive business models, and top-tier talent, propelling them forward in an increasingly competitive market.

Research Findings on U.S. Unicorn Acquisitions

Research findings

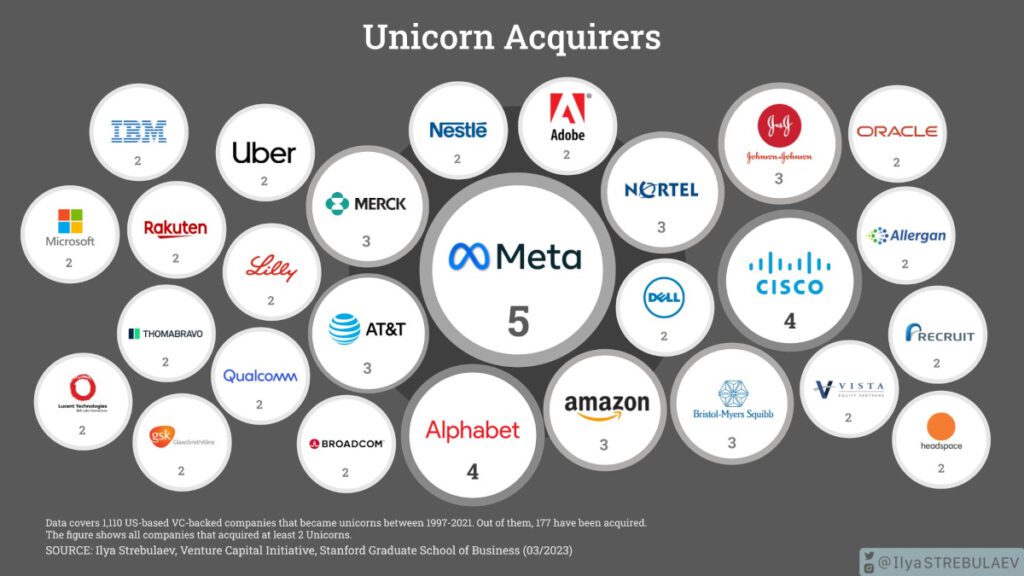

Extensive research has shed light on the companies that have made the most unicorn acquisitions in the United States since 1997. Multiple sources, including Visual Capitalist [1], Zero Hedge [2], and Alt News [8], provide valuable insights into the top acquirers and their contributions to the startup ecosystem.

According to the research findings, several companies have stood out for their significant number of unicorn acquisitions. These acquirers have showcased their strategic vision and ability to identify promising startups with high growth potential. While the exact rankings may vary slightly across sources, the top acquirers consistently emerge as key players in the unicorn acquisition landscape.

Top acquirers

Alphabet Inc.

One of the leading acquirers is Alphabet Inc. (formerly Google), a technology giant renowned for its innovative solutions. Alphabet has made substantial strides in acquiring unicorns, positioning itself at the forefront of the startup acquisition game. Companies like Nest Labs, DeepMind Technologies, and Looker Data Sciences are among the notable unicorns that have become part of the Alphabet family.

Meta (Facebook)

Another prominent acquirer is Facebook, a social media behemoth that has expanded its reach through strategic unicorn acquisitions. By acquiring companies like Instagram, WhatsApp, and Oculus VR, Facebook has solidified its position as a dominant force in the digital realm and has capitalized on emerging trends and user preferences.

Amazon

Amazon, the global e-commerce powerhouse, has also demonstrated a penchant for unicorn acquisitions. The company’s acquisitions of Zappos, Ring, and PillPack have helped diversify its business offerings and enhance its customer experience. Amazon’s strategic approach to acquisitions has propelled its growth and reinforced its market dominance.

Contribution to ecosystem

The top acquirers in unicorn acquisitions have made significant contributions to the startup ecosystem. These companies bring together a unique blend of financial resources, technological expertise, and market influence, creating synergies that benefit both the acquirer and the acquired startups.

By acquiring unicorns, these companies gain access to disruptive technologies, innovative business models, and entrepreneurial talent, driving their own growth and evolution.

Unicorn acquisitions have reshaped industries, accelerated innovation, and rewritten the rules of competition.

An expert in the field

They enable established companies to embrace change, infuse fresh ideas, and remain agile in an ever-evolving business landscape

Success Stories and Lessons Learned

Successful unicorn acquisitions – Instagram by Facebook

One notable success story is the acquisition of Instagram by Facebook. By recognizing the growing trend of visual content and the potential of Instagram’s user base, Facebook made a bold move to acquire the popular photo-sharing platform.

This acquisition not only expanded Facebook’s reach but also allowed Instagram to leverage Facebook’s resources and expertise in scaling its platform globally. The success of this acquisition lies in Facebook’s ability to identify a promising startup and capitalize on its growth potential.

Successful unicorn acquisitions – LinkedIn by Microsoft

Another success story is Microsoft’s acquisition of LinkedIn. Recognizing the power of professional networking and the vast user base of LinkedIn, Microsoft made a strategic move to acquire the platform.

This acquisition enabled Microsoft to strengthen its position in the business and enterprise software market, while also leveraging LinkedIn’s data and user insights to enhance its product offerings. The success of this acquisition can be attributed to Microsoft’s ability to identify synergies and leverage the unique strengths of both companies.

Lesson to learn

These success stories offer valuable lessons for other companies looking to emulate their strategies in unicorn acquisitions.

Deep understanding of market trends

Firstly, it is crucial to have a deep understanding of market trends and emerging technologies. By identifying startups that align with these trends, companies can position themselves for success in acquiring unicorns.

Building strong relationships and networks

Secondly, building strong relationships and networks within the startup ecosystem is vital. Actively engaging with entrepreneurs, attending industry events, and fostering partnerships can provide valuable insights and access to potential acquisition targets.

Maintaining a long-term strategic vision

Additionally, maintaining a long-term strategic vision is crucial. Successful acquirers understand the value of nurturing and supporting the acquired startups, allowing them to maintain their innovative culture and continue driving growth. This approach fosters a collaborative environment that benefits both the acquirer and the acquired company.

It is not just about the acquisition itself but also about nurturing the acquired startup and unleashing its full potential within the broader organization.

An expert in the field

Future Trends in Unicorn Acquisitions

The future outlook for unicorn acquisitions in the United States remains promising, as the startup ecosystem continues to evolve and expand. However, the landscape for unicorn acquisitions is shaped by various market conditions and emerging trends, which can impact the frequency and nature of these acquisitions.

Current market conditions in the U.S.

Currently, the market conditions are favorable for unicorn acquisitions. Economic stability, access to capital, and investor confidence all contribute to an environment conducive to strategic acquisitions. Companies with strong financial positions and a focus on innovation are well-positioned to capitalize on these conditions and pursue unicorn acquisitions.

Emerging industries & sectors

Looking ahead, certain industries and sectors are expected to be hotspots for unicorn acquisitions.

Tech – AI, Blockchain, Cybersecurity

The technology sector, encompassing areas such as artificial intelligence, blockchain, and cybersecurity, is poised for continued growth and disruption. Companies seeking to stay at the forefront of technological advancements are likely to target promising startups in these fields through acquisitions.

Tech – Healthcare

Another emerging area where unicorn acquisitions are expected to be prevalent is the healthcare sector. With advancements in digital health, personalized medicine, and telehealth, startups in this space are attracting significant attention and investment. Established healthcare companies may look to acquire these unicorns to enhance their capabilities, expand their market presence, and leverage the transformative potential of technology in healthcare.

Future of unicorn acquisitions

A reputable source, TechCrunch, predicts the future of unicorn acquisitions with the following quote:

As the startup ecosystem matures, unicorn acquisitions will become a primary means for companies to access innovation and talent.

Techcrunch

Established players will seek to acquire startups that offer unique technologies, intellectual property, and disruptive business models

Additionally, cross-industry collaborations and partnerships are likely to shape the future of unicorn acquisitions.

Traditional companies outside the technology sector, such as financial institutions, retail giants, and automotive manufacturers, are increasingly recognizing the need to embrace digital transformation.

Acquiring unicorns provides them with a fast-track to accessing innovative technologies and staying relevant in the evolving market landscape.

With favorable market conditions, emerging industries, and the increasing importance of innovation, companies will continue to pursue strategic acquisitions of unicorns to drive growth, remain competitive, and capitalize on disruptive opportunities.

By staying attuned to market trends, nurturing relationships within the startup ecosystem, and maintaining a forward-looking approach, companies can position themselves for success in the dynamic world of unicorn acquisitions.