The return of the tech stock champions! The rise and fall of the US stock market depend on these top 5 giants, but could this be hiding underlying risks?

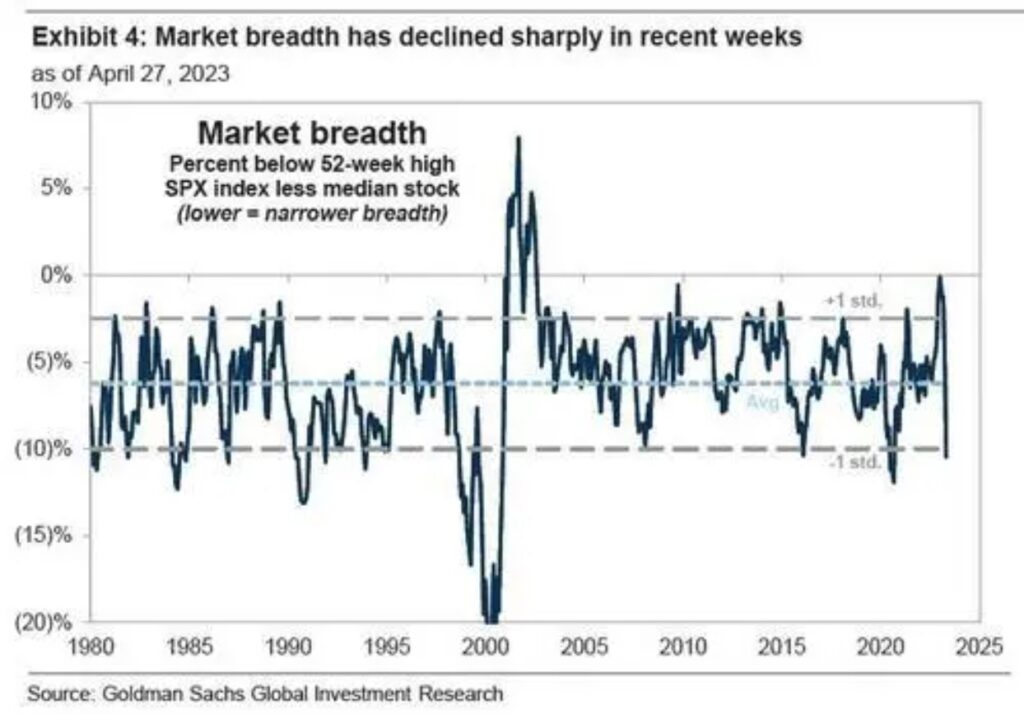

The market breadth, which measures the ratio of stocks experiencing price increases to those experiencing price decreases, has dropped to its lowest level in three years. Looking back at the past four decades, every time the market breadth has significantly narrowed, the US stock market has experienced a major decline.

While the kings of the tech stocks are making a comeback, it may be overshadowing the hidden risks present in the US stock market.

So far this year, Microsoft, Apple, Amazon, Google’s parent company Alphabet, and Meta Technology have experienced gains of 18% to 39%, outperforming the S&P 500 index by 2 to 4 times.

Considering the size of these five giants, if we exclude these stocks, the performance of the remaining 495 companies in the S&P 500 index is not ideal.

At the same time, the market breadth, which measures the ratio of stocks experiencing price increases to those experiencing price decreases, is intensifying its contraction, currently reaching its lowest level in three years. Looking back at the past four decades, every time the market breadth has significantly narrowed, the US stock market has experienced a major decline.

Serious Consequences of Market Narrowing: Tech Giants’ Dominance Increases

The market narrowing has intensified, leading to severe consequences. Last week, Goldman Sachs raised its alert level for the record-breaking collapse of market breadth to level 11.

David Kostin, the bank’s chief equity strategist, stated, “The recent sharp contraction in market breadth indicates an increase in withdrawal risks.” Similar warnings were issued by J.P. Morgan and Societe Generale.

Kostin examined the recent performance of Alphabet, Apple, Microsoft, Meta, and Amazon and found that these five stocks accounted for 89% of the year-to-date returns of the S&P 500 index. He warned that market breadth has contracted below the average standard deviation of one percentage point for the first time since 2020.

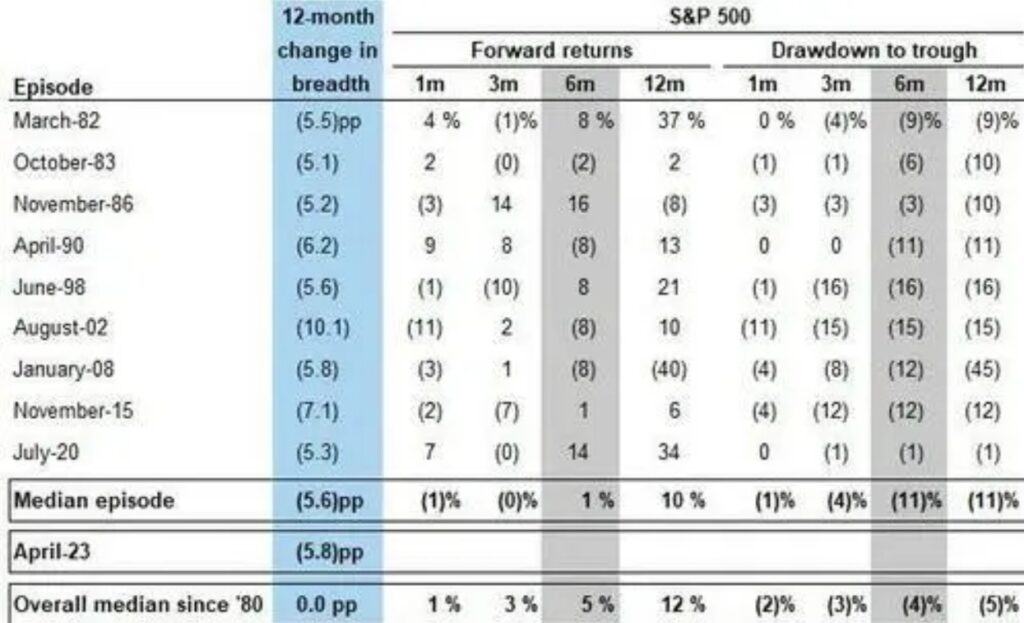

The strategist then reviewed historical performance and discovered that every significant narrowing of market breadth since 1980 was followed by a substantial decline in the S&P 500 index. The subsequent returns were below average, with greater peak-to-trough declines, and a median six-month return rate of -11%.

In fact, since Goldman Sachs issued its initial warning, market breadth has become even narrower, exacerbating the problem.

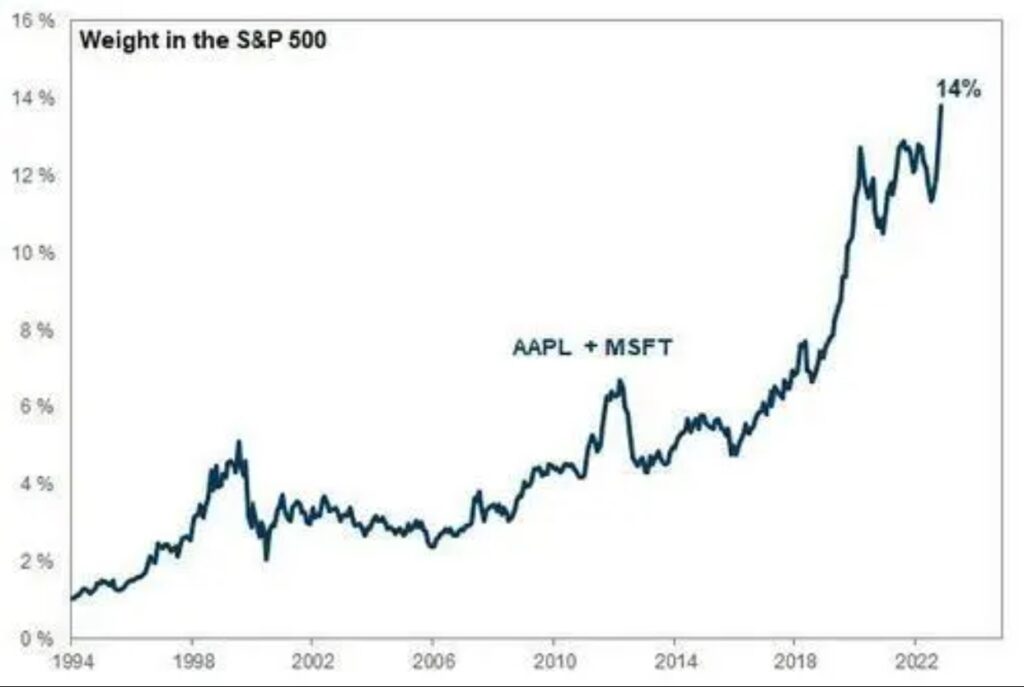

In the past week, apart from Amazon, the stock prices of all major tech giants have continued to rise. According to a report released earlier by Goldman Sachs analyst Scott Rubner, the two largest tech giants, Apple and Microsoft, have seen their market capitalization weights in the S&P 500 index increase parabolically.

Therefore, Kostin issued a warning for the second time in his weekly Kickstart report.

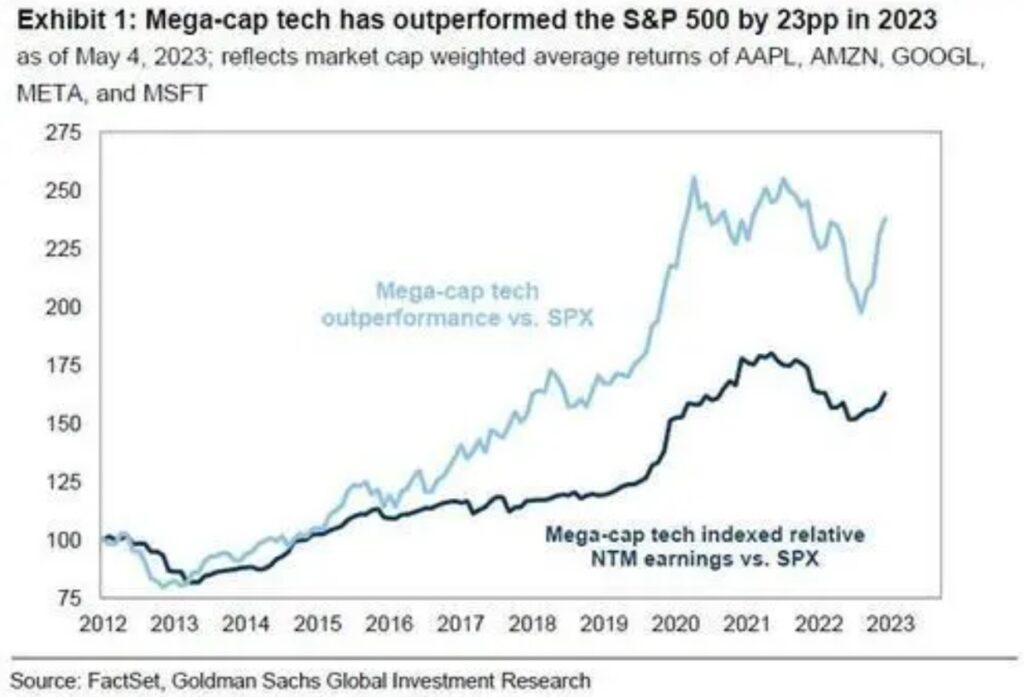

In the new report, Kostin straightforwardly points out that mega-cap tech stocks have outperformed the S&P 500 index by 23% year-to-date, accounting for the largest share of its 6% return.

Year-to-date, the returns of the top five tech stocks range from 19% to 94%, with an overall return rate of 29%. Due to their impressive returns, the market capitalization of large-cap tech stocks has soared.

Kostin states that the weight of large-cap tech stocks in the S&P 500 index has rebounded from 18% in December last year to the current 22%. However, it is still below the peak of 25% reached in August 2020.

Resilience of Large Tech Stocks in the Face of Economic Recession

In times of economic recession, are large tech stocks becoming safe havens? A closer look reveals that the rise of these stocks is primarily driven by improved fundamental prospects.

During 2022, analysts lowered their average earnings per share forecast for large tech companies in 2023 by 27% due to sluggish post-pandemic growth. However, their performance in the first quarter of this year exceeded market expectations, resulting in upward revisions to earnings per share.

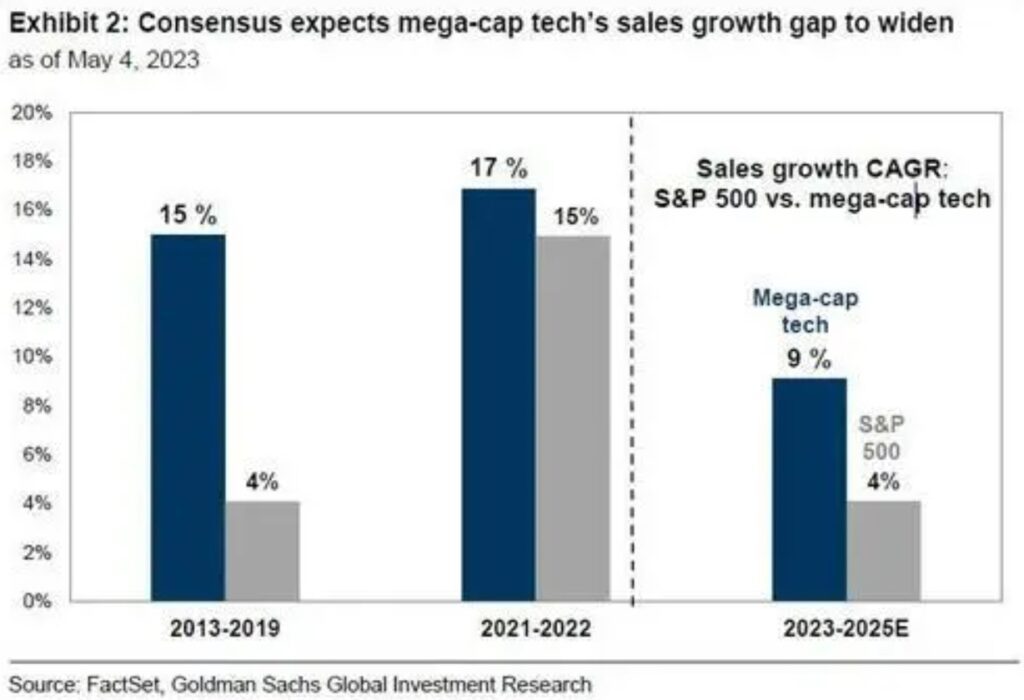

Furthermore, despite a narrowing gap between the sales growth of large tech companies and the index constituents from 2021 to 2022, analysts predict that this gap will further widen.

From 2013 to 2019, the average annual sales growth rate of large tech companies was 15%, compared to just 4% for the S&P 500 index constituents, representing an 11-percentage-point difference. However, from 2021 to 2022, as the sales growth of all index constituents accelerated, this gap narrowed to 2 percentage points.

Looking ahead, Goldman Sachs believes that although the annual sales growth of mega-cap tech stocks is expected to slow from 2023 to 2025, the gap with the index is projected to expand to 5 percentage points.

Kostin also suggests that the long-term prospects of large tech stocks may benefit from the advancement of AI technology.

Goldman Sachs estimates that AI could drive global economic growth by approximately $7 trillion in the next 10 years, with the market size of generative AI (AIGC) software reaching $150 billion. Among all tech stocks, Microsoft, Google, Amazon, and Meta are most likely to reap the benefits.

Another reason for the strong performance of large tech stocks could be higher profit margins.

According to Goldman Sachs’ calculations, the average net profit margin of large tech stocks over the past five years was 20.2%, while the profit margin for all S&P 500 index constituents was 10.9%, resulting in a difference of 9.3 percentage points. In 2022, the profit margin of large tech stocks was 7.8 percentage points higher than that of all index constituents, but Goldman Sachs believes that the profit margin of large tech stocks bottomed out in the fourth quarter of last year and expects the gap to widen to 8.1 percentage points in the fourth quarter of this year.

It is worth noting that higher profit margins imply stronger cash flows, which contribute to further investments for long-term growth and cash returns to shareholders. In 2022, capital expenditures and research and development accounted for 57% of the cash outflows of large tech stocks, while share buybacks increased from 14% in 2012 to 36%. Research and development and share repurchases accounted for 26% and 24% of the cash outflows of all S&P 500 index constituents, respectively.

In addition to these factors, the recent macroeconomic environment has also provided support for the stock prices of tech giants. Despite the ongoing rate hikes by the Federal Reserve putting pressure on tech stocks, the escalating crisis in the U.S. banking industry and significant economic slowdown have led to a decrease in U.S. bond yields. As a result, more investors are turning to large tech stocks and other high-quality stocks.

According to Kostin, in the event of renewed economic recession fears, investors perceive stocks of large tech companies as defensive stocks.

What to Expect for the US Stock Market: Impact of Market Breadth Contraction and Potential Tech Giant Outcomes

In recent times, there are concerns about what will happen in the US stock market. The key question is, to what extent will the contraction in market breadth impact the overall market? When will the volcano erupt?

Last week, Kostin warned that the collapse of market breadth would end tragically. However, he further explained that it might take a long time for this to happen.

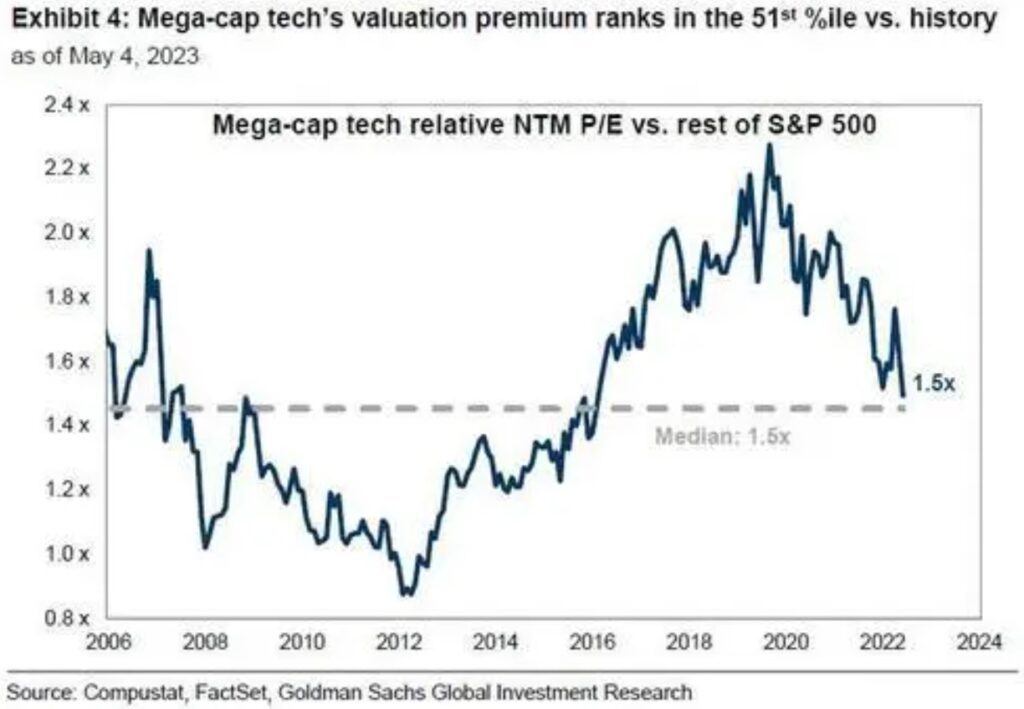

If the current economic conditions continue with below-trend growth and declining yields, the mega-cap tech companies may maintain their valuation premiums and continue to outperform the broader market.

The mega-cap tech companies currently have a price-to-earnings ratio of 25 times, representing a premium of 49% compared to other constituents of the S&P 500 index, ranking in the 51st percentile historically.

Kostin predicts that in his baseline scenario of a “soft landing,” the recession risk will eventually fade away, and interest rates will continue to rise. In such an environment, the performance of large-cap tech stocks may lag behind smaller, more cyclical stocks.

However, the market clearly disagrees with this view. Current pricing in the futures market indicates a total of 100 basis points cut in the federal funds rate by the end of the year, while Goldman Sachs predicts that the Federal Reserve will not cut interest rates before year-end.

Regardless, it is certain that if interest rates rise, tech giants’ stocks may face greater impact compared to other companies.

If the US economy enters a recession and yields decline, the giant tech stocks will continue to be seen as defensive stocks, potentially driving the overall market to new heights. There is also a possibility that if economic growth falls below expectations or even enters a recession, investors may reduce overall stock exposure, which could put pressure on large-cap tech stocks.

Large-cap tech stocks are among the most favored long positions by hedge funds. However, during risk-averse events, these stocks are often the first to be sold off as funds tend to liquidate more popular and liquid stocks. In Goldman Sachs’ VIP investment portfolio for hedge funds, all five large-cap tech stocks rank among the top 10 long positions.