Vietnam’s startup ecosystem is gaining attention as the quality of IT talents in the country improves and experienced entrepreneurs with international exposure grow in number. In recent years, a myriad of services and products originating from Vietnam have gone global. While the amount of venture capital investment in 2022 decreased by over 50% compared to the previous year, investors remain optimistic about the potential of Vietnamese startups.

According to Chad Ovel, a partner at the Ho Chi Minh City-based venture capital firm, Mekong Capital, “Vietnam has given birth to globally applicable products. It’s like a ‘New Vietnam'”. With an abundance of resources, favorable policies, and a growing entrepreneurial culture, Vietnam’s startup scene presents a wealth of opportunities for both local and foreign investors.

Vietnamese Dream To be IT Engineers

Sky Mavis, a blockchain gaming developer, paved the way for the “Play to Earn” model in 2018 with their game, Axie Infinity. In countries like the Philippines, users are even earning a living through playing this game. As a result of Axie Infinity’s success, many similar services have been developed. Surprisingly, the pioneers in this industry were born in Vietnam, not the US or China.

The reason behind this rapid development in Vietnam is the large number of IT engineers, with around 500,000 people in this profession. Many Vietnamese men aspire to become engineers, and prestigious universities like Hanoi University of Science and Technology have produced many talented individuals. Even Japan’s largest image material service provider, PIXTA, has established an AI research and development team in Vietnam.

More and more Vietnamese entrepreneurs are studying the latest technologies abroad and gaining exposure to the world beyond Vietnam. LiveSpo Global’s founder, Dr. Nguyen Hoa Anh, studied molecular biology at Japan’s Tohoku University for over 10 years. His company exports health products that use microorganisms to regulate the body’s environment to over 20 countries worldwide.

Global Financial Impact on Vietnam’s VC Investment

Marou Chocolate is a premium chocolate brand that owes its success to the persistence of its founder, Vincent Mourou. After switching careers from advertising, the Frenchman became obsessed with Vietnamese cocoa beans that were previously unknown. He transformed them into a chocolate brand that now sells in more than 30 countries worldwide. What was once limited to “international experience” in Russia has become rich and diverse.

However, investing in Vietnam has become more challenging in recent years. According to a report by the National Innovation Center (NIC) in Vietnam, investment in start-ups decreased by 56% in early 2022 compared to the previous year, with a total investment amount of only $634 million and a reduction of almost 20% in the number of projects to 134. CB Insights also revealed that global investment in start-ups decreased by 35%, affecting Vietnam.

The decrease in large-scale investments in 2021 has further aggravated the decline in investment amounts. In 2021, there were five projects that raised more than $50 million in funding, such as M_Service’s mobile payment service “MoMo” and Vietnam’s version of Amazon, “Tiki,” with a total funding amount of $960 million, accounting for nearly 70% of the overall investment. In 2022, there were only two projects, with a total funding amount of less than $200 million, only one-fifth of the previous year’s amount.

Investing in Vietnam: A Promising Opportunity for Entrepreneurs

Despite the many challenges faced by emerging markets, investors remain optimistic about Vietnam’s potential for growth. One seasoned and capable Japanese investor who has worked with multiple investment funds states, “Vietnam’s economy is growing, its domestic demand is expanding, and its workforce is diligent. This country will continue to see an increase in startups.” In mid-April, he traveled to Hanoi and decided to invest in educational startups.

Former President of the Japan Innovation Network Corporation (INCJ), Katsunori Yago, smilingly stated that “there are many sharp issues.” He held a special lecture on startup companies in Hanoi’s Dai Viet University in April and stated that he “felt a great possibility from the attentiveness of the audience.”

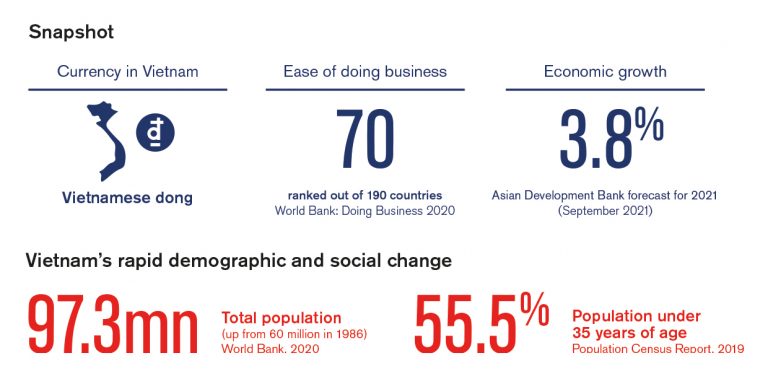

Investors see Vietnam’s young population, expanding middle class, and favorable demographics as potential drivers of growth. Additionally, Vietnam’s strategic location, proximity to China, and membership in the ASEAN Economic Community provide an ideal environment for businesses seeking to expand their market reach.

Despite some challenges, such as inadequate infrastructure, Vietnam’s startup ecosystem is rapidly growing and is poised to become a major player in the Southeast Asian startup scene. In fact, the World Bank ranked Vietnam as the fifth-best country in the world to start a business in 2020.

Investing in Vietnam’s startup ecosystem can provide a promising opportunity for entrepreneurs looking to enter a dynamic and rapidly growing market. With its favorable demographics, strategic location, and expanding middle class, Vietnam is poised to become a major player in the Southeast Asian economy.